Central Bank Digital Currencies (“CBDCs”) have the potential to radically transform the financial system, and all signs point to that transformation being a detriment to citizens around the globe. There are multiple human rights concerns surrounding their implementation and use.

Let’s not lose touch…Your Government and Big Tech are actively trying to censor the information reported by The Exposé to serve their own needs. Subscribe to our emails now to make sure you receive the latest uncensored news in your inbox…

Many people regularly use multiple forms of digital money. We make digital payments using credit, debit, and prepaid cards, as well as mobile payment apps like PayPal.

It’s not just payments that have gone digital. Nearly every financial institution offers services – from savings accounts to mortgages – via mobile applications.

So, money is already widely available in digital form. The current system works so well that few people ever take the time to worry about whether the digital money they are using is a liability of, for example, Visa or a liability of their bank.

So why are governments considering implementing CBDCs?

Unlike the current system of digital money, with CBDCs, digital money would be a liability of the central bank. In other words, governments have the direct responsibility to hold, transfer or otherwise remit those funds to the ostensible owner. This feature creates a direct link between citizens and the central bank. And it is this feature that opens the door to so many human rights concerns when it comes to the adoption of CBDCs.

These concerns cover issues of financial privacy, freedom, stability and cybersecurity. The Human Rights Foundation’s (“HRF’s”) CBDC Tracker website notes the following as the concerns regarding CBDCs:

- Sweeping financial surveillance. Around the world, governments routinely pressure banks and other financial institutions to supply customer information. From Canada to Russia, this practice has become all too common. The difference between what is experienced today and what would be experienced with a CBDC, however, is that the financial records would be on government databases by default. In other words, a CBDC could spell doom for what little protection remains because it would give governments complete visibility into every financial transaction.

- Restricting financial activity.

- Freezing funds.

- Seizing funds.

- Imposing negative interest rates. Proposals for CBDCs often tout negative interest rates as a benefit because it would offer policymakers “greater control” over the economy. For citizens, however, a negative interest rate amounts to a fine or tax for saving money.

- Disrupting financial stability.

- Disrupting cryptocurrency. Globally, governments have demonstrated that they want a CBDC specifically to hold on to their monopoly over national currencies. For instance, China banned cryptocurrencies just as its CBDC was launched; India announced its plans for a CBDC while simultaneously calling for a ban on cryptocurrency; and Nigeria prohibited banks from cryptocurrency transactions just as it launched its CBDC.

- Putting the economy at risk of cyberattacks.

- Creating a new tool for corruption.

For additional information on concerns regarding the risks of CBDCs, HRF recommends the Cato Institute’s webpage titled ‘The Risks of CBDCs: Why Central Bank Digital Currencies Shouldn’t Be Adopted’ and report titled ‘Central Bank Digital Currency: Assessing the Risks and Dispelling the Myths’.

HRF is a non-partisan, non-profit organisation that promotes and protects human rights globally, with a focus on closed societies. On its home page, is an option to select a specific country from a drop-down list and read HRF’s assessment of the status of CBDCs for that country.

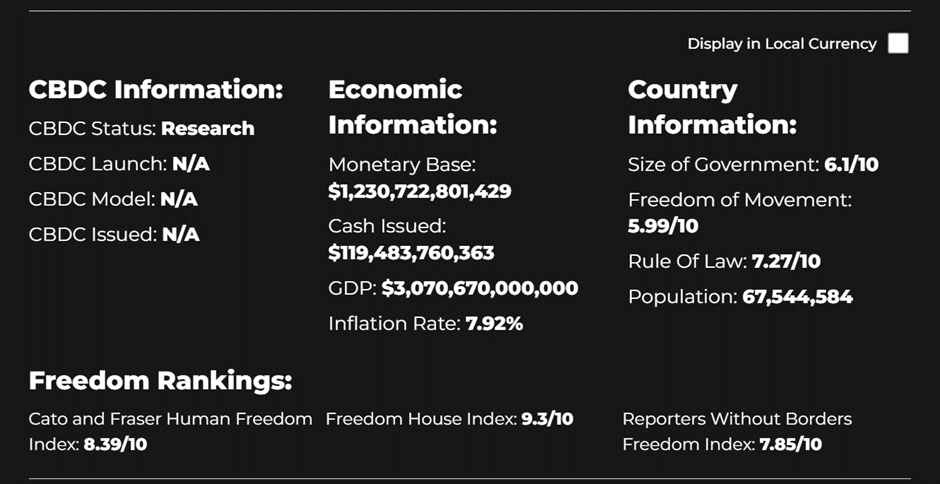

Selecting the United Kingdom as an example, the page begins with the summary as shown in the image below. What’s striking about this summary is the low score the UK has been given for freedom of movement.

HRF has based its freedom of movement metrics on the freedom of foreign movement, the freedom of movement for money and the freedom of movement for women. “There is a two-year lag with this data point due to the availability of the data that goes into it,” HRF states.

A more detailed explanation of this metric can be found in the 2023 Cato Institute and Fraser Institute Human Freedom Index (“HFI”) HERE. It relates to the year 2021.

Human freedom deteriorated severely in the wake of the coronavirus pandemic. Most areas of freedom fell, including significant declines in the rule of law; freedom of movement, expression, association and assembly; and freedom to trade. After having fallen significantly in 2020, human freedom remained low during the second year of the pandemic.

The findings in the HFI suggest that freedom plays an important role in human well-being…

Human Freedom Index 2023, Cato Institute

Returning to the status of CDBCs in the UK. Among others, HRF has this to say:

The United Kingdom is currently in the research phase. The Bank of England’s official statement said, “The Government and the Bank of England have not yet made a decision on whether to introduce a CBDC in the UK, and will engage widely with stakeholders on the benefits, risks and practicalities of doing so.” With respect to engagement, the Bank of England has since published both a discussion paper and a technical paper to explore various CBDC designs.

However, while these may only seem exploratory, it’s important to note that the Bank of England also said, “the Bank of England and HM Treasury judge there is likely to be a future need for, and benefits from, a digital pound.”

A 2023 consultation paper from the Bank of England said that a digital pound would require individuals to verify their identity, accounts to have capacity limits and varying levels of programmability. The Bank of England received over 50,000 responses from the public—primarily due to concerns about privacy, programmability, and the decline of cash.

Human Rights Foundation CBDC Tracker (Country: United Kingdom), retrieved 12 January 2023

The Expose Urgently Needs Your Help…

Can you please help to keep the lights on with The Expose’s honest, reliable, powerful and truthful journalism?

Your Government & Big Tech organisations

try to silence & shut down The Expose.

So we need your help to ensure

we can continue to bring you the

facts the mainstream refuses to.

The government does not fund us

to publish lies and propaganda on their

behalf like the Mainstream Media.

Instead, we rely solely on your support. So

please support us in our efforts to bring

you honest, reliable, investigative journalism

today. It’s secure, quick and easy.

Please choose your preferred method below to show your support.

Categories: Breaking News, World News

Most of the global population (BRICS) has turned its back on the USD (Russia, China, India, Brazil, South African and South American countries and many more lined up to join. The USD is losing money, control and power fast and their rapid race to lock in digital to keep control is what they are pushing to prevent this collapse. BRICS was started up in the 80s by Rothchilds or Rockefellars (cant remember which). It is all part of the global elite manipulation to pit everyone against the other for their gains.

Even more concerning to me is the banking system is secretly organising a collapse of USD and stockmarkets. The stockmarket collapse by 2025 was predicted by Deagle. The lending industry has been secretly changing lending legislation, so when the dollar collapses, the banks will acquire all property with a mortgage on it, even if your contracts with the bank say otherwise. The players, strategies and motivations are set.

You and every man or woman on the planet are as rich as Midas.

It is your responsibility to claim those riches though.

https://globalfamilygroup.com/lrps.html

Click NEW/INDIVIDUAL and CORRECT YOUR STATUS.

Take 5 minutes to fill in the form which gets the ball rolling.

Don’t expect a reply for 3-4 months via email.

Central bank digital currencies are dead in the water.

Infrastructure not in place to handle the volume of digital transactions.

Central banks can’t use fractional reserve lending like they did with their ponzi Fiat currency.

Basically, what’s in it for the bwankers other than the power to decide who lives or dies?

that’s enough for them. They already have the money and the wealth. The mark of the beast will determine who lives or dies.

CBDCs, Digital ID, and VACCINES are merging together.

COMING SOON: DIGITAL ID – (QUANTUM DOT TATTOO): Microsoft Platform for finances & Storage of ALL personal data on the physical body coming with a MICRONEeDLE SKINPATCH/ VA666INE like a band-aid) – will provide Proof of Va666ination Compliance – and will be the MARK OF THE BEAST needed to “participate in society” or access Internet and your accounts (Code for buy and sell)

==> You won’t be held down and forced that way; but as Microsoft said about their Worldwide Digital ID system, “non-participants will be unable to buy or sell goods or services”. People who don’t get it just won’t be able to buy and sell; your financial transactions will be blocked. It looks like a patch with tiny spikes and can come in the mail. This is part of the ID Alliance 2020 (compare with Revelation 13:16-18 and 14:9-12)

I don’t know how biometrics are tied in at this point, but it is too close for comfort.

THE RFID CHIP IS OLD TECHNOLOGY AND A RED HERRING TO DISTRACT US AWAY FROM THE QUANTUM DOT TATTOO.

Bill Gates went to MIT to fund the QDT, and he has patents for CBDC, also coming from, I think, MIT. MIT has DIGITAL CURRENCY INITIATIVE.

https://www.evangelicaloutreach.org/microneedle-patch-quantum-dot-tattoo-mark-of-the-beast.htm

This is the first JPG I meant to post, but I did not see an edit button.

https://www.youtube.com/watch?v=Prpue5GZZ6M

Thanks John, very interesting

The only way to get the article is to hit on comments and scroll to the top to see the article

I got the same funny that isn’t it