Wednesday’s AR7 results show that Ed Miliband, NESO and the CCC are gaslighting the nation.

AR7 is locking in index-linked high electricity prices for decades. And it is UK taxpayers and energy consumers who are footing the bill for these expensive, unreliable and disastrous “renewable” energy projects.

The auction results for AR7 are a disaster for Britain, David Turver writes. Miliband is locking in higher prices for intermittent offshore wind for decades to come. We already have the highest industrial electricity prices in the world. Pushing up prices even higher will accelerate deindustrialisation.

We cannot afford this madness, and we cannot let Miliband, NESO and the CCC continue to gaslight us about the cost of Net Zero. This is a disastrous policy that is leading to economic distress and causing the social fabric of the nation to unravel.

Let’s not lose touch…Your Government and Big Tech are actively trying to censor the information reported by The Exposé to serve their own needs. Subscribe to our emails now to make sure you receive the latest uncensored news in your inbox…

Explainer: NESO, CCC and AR7

Ed Miliband is the UK’s Secretary of State for Energy Security and Net Zero.

NESO, or the National Energy System Operator, is a government-owned energy system operator for Great Britain. It is claimed that NESO is “independent” of the Government, but this claim is purely for optics.

CCC, or the Climate Change Committee, is the UK’s independent, statutory body established under the Climate Change Act 2008. It advises the UK and devolved governments on emissions targets, including setting five-year carbon budgets and long-term goals such as the legally binding net zero emissions target by 2050. The CCC also reports annually to Parliament on progress toward these targets and assesses the UK’s preparedness for climate change impacts through its Adaptation Sub-Committee. The CCC is corrupt and incompetent. The cost of its modelling errors and misleading advice could cost UK taxpayers trillions of pounds. It should be disbanded, the sooner the better.

AR7, or Contracts for Difference (“CfD”) Allocation Round 7, is the seventh of the now annual government auctions to build and operate offshore wind turbines in the UK. It was “Europe’s biggest ever offshore wind auction” and awarded 8.4 gigawatts (“GW”) of offshore wind capacity to private companies.

The CfD scheme guarantees renewable generators a fixed “strike price” for electricity over 20 years. If market prices fall below this, the generator is topped up; if they rise above, the generator repays the difference. Analysis of data published by the Low Carbon Contract Company shows the CfD scheme cost a record £2.4 billion in subsidies during the calendar year 2024. CfD’s are only one of three government “renewable” energy subsidy schemes, the other two being Renewable Obligations Certificates (“ROCs”) and Feed-in-Tariffs (“FiTs”). The total cost of these subsidy schemes amounts to nearly £12 billion per year, or more than twice the amount spent on gas for electricity.

In the following, David Turver explains the results of AR7 and what this means for us, the taxpayers who are footing the bill and also suffer the consequences of these disastrous policies.

Further reading:

- Ed Miliband’s “independent” advice on “clean power” scam

- Corrupt and incompetent UK Climate Change Committee should be disbanded

- UK energy costs: We face an existential threat; it is either us or the Green Blob

- Net Zero is collapsing faster than the coal-fired power stations blown up by Alok Sharma

AR7 Results Show Miliband, NESO and CCC are Gaslighting the Nation

By David Turver, 15 January 2026

Table of Contents

Introduction

Each year, the Government runs an auction for new renewables capacity. The latest auction, Allocation Round 7 (“AR7”) has been run differently to previous auctions and run on a slightly later timeline. The results of the first part of the auction for offshore wind technologies were announced yesterday [Wednesday, 14 January 2026].

The AR7 results have been lauded as a great success by Energy Secretary Ed Miliband, but beneath the surface, there is much to worry about.

AR7 Results

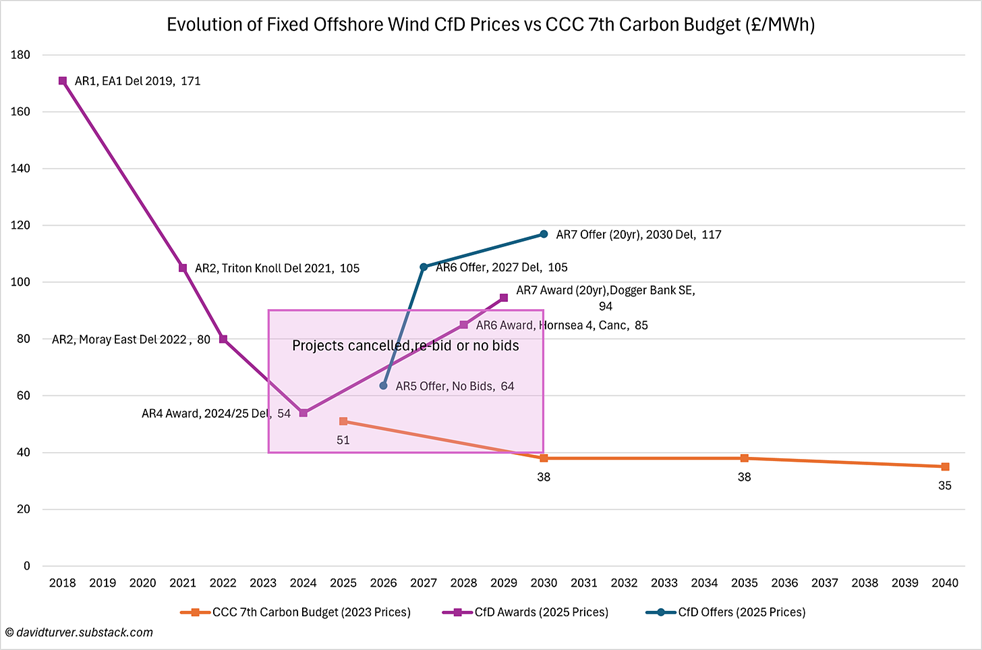

A total of 8.4GW of offshore wind capacity has been awarded contracts. The vast majority of this, or 8.2GW, has been awarded to fixed-bottom offshore wind at an average price of £90.91/MWh in 2024 prices. The balance of 0.2GW has been awarded to floating offshore wind at a price of £216.49/MWh, again in 2024 prices. Both prices are somewhat below the maximum prices on offer of £113/MWh and £271/MWh, respectively. On the face of it, this is good news but it does reveal that the costs of offshore wind have increased significantly since the AR6 auction in 2024, see Figure 1.

For Figure 1, the prices have been converted to a 2025 base. We can see the strike price is about £9/MWh above the £85/MWh awarded to the now cancelled Hornsea 4 in AR6. However, we need to remember that Hornsea 4 was awarded a 15-year contract and AR7 contracts have a term of 20 years. On a like-for-like basis, the AR7 contracts are probably worth about £105/MWh.

It is worth noting that the AR7 contract awards are considerably above the £38/MWh for offshore wind assumed by the Climate Change Committee (“CCC”) in their seventh carbon budget (“CB7”). More on that below.

Will The AR7 Projects Get Built?

Figure 1 shows that projects awarded contracts in AR4 have either been cancelled (Norfolk Boreas) or partially re-bid at higher prices (for example, Hornsea 3). There were no bids in AR5 and the flagship AR6 project, Hornsea 4, was cancelled by Orsted. Given this track record, it is valid for us to ask whether these projects will be built at the agreed price. Let us consider the risks.

First, there is commodity price risk. Copper is a big component of the material costs of offshore wind power. It is required for the generators, transformers, control systems and, of course, the extensive cable networks required to connect turbines to shore. The copper price is up about 40% from $4.20/lb in late January 2025 to about $6/lb today. Moreover, Neodymium, a key element in the permanent magnets used in wind turbines, is up about 60% since this time last year. Higher commodity prices will significantly impact the build costs.

Second, there is the supplier concentration risk. The developer behind almost all the fixed-bottom offshore wind contracts is RWE. They are the operator for Awel y Môr, Dogger Bank South (East and West) and Norfolk Vanguard East and West, giving a total of 6.9GW or 83% of the 8.2GW fixed-bottom offshore wind capacity. If we assume an approximate spend of £3 billion per gigawatt of capacity, that means the total project cost is going to be around £20 billion.

Last year RWE announced it was scaling back its green energy investments, so yesterday’s results are something of a surprise. RWE have already farmed down stakes in Awel y Môr and the Dogger Bank South projects. Yesterday it also announced a partnership with private equity firm KKR, who are going to take on 50% of the Norfolk Vanguard projects. This mitigates the risk somewhat, but their Sofia offshore windfarm project appears to be running behind schedule and, as we shall see in a forthcoming article, their Scroby Sands project is highlighting that the costs of decommissioning are going up.

The third, smaller risk is planning permission. According to its website, the Dogger Bank South projects are yet to receive planning permission. It seems they are waiting on a recommendation from the Planning Inspectorate and then a decision by the Secretary of State, Ed Miliband. It does seem likely that Ed will grant permission if the Planning Inspectorate makes a positive recommendation, but the risk remains.

There is a final risk to taxpayers because the Pentland Floating Offshore Wind project is a partnership between GB Energy, National Wealth Fund, Scottish National Investment Bank, Eurus Energy and Hexicon AB. It looks like the taxpayer is on the hook for a considerable portion of the costs of this risky and expensive project.

AR7 Claims

The Department of Energy Security and Net Zero (“DESNZ”) has made an announcement accompanying the results and Ed Miliband has produced a thread on X celebrating his decisions. The trouble is, they have both made claims that are demonstrably false.

First, Ed Miliband claimed that the new capacity secured in AR7 “is 40% lower than the alternative cost of building and operating a new gas plant”, see Figure 2.

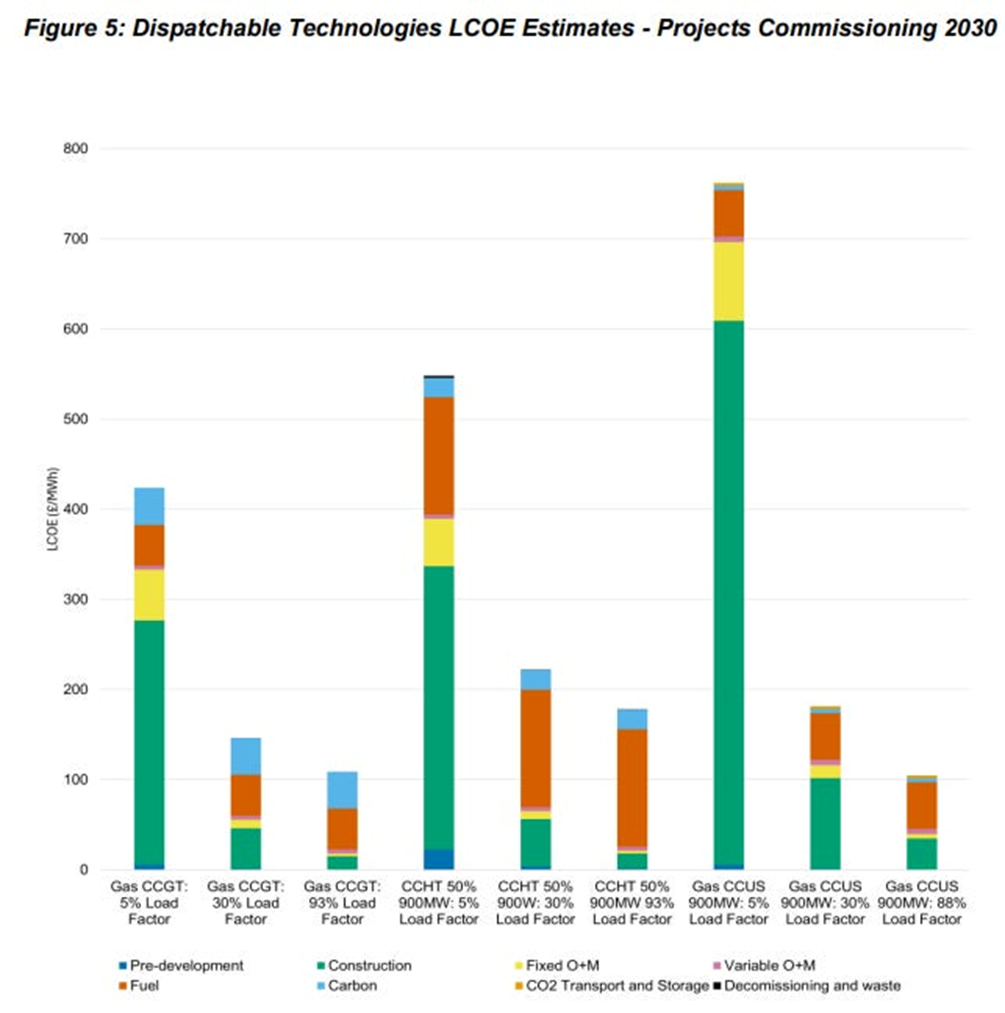

This claim comes from his interpretation of the Electricity Generation Cost Report 2025 that was also published yesterday, see Figure 3.

It appears as though Ed has compared the cost of offshore wind to gas-fired generation operating at just 30% load factor with a cost of £145/MWh in 2024 prices. First, his maths is wrong because the average £90.91/MWh is only 37.3% lower than £145. Second, a more realistic counterfactual would be not building more windfarms and running new gas-fired generators nearly all the time. Under this scenario, the cost of gas-fired generation falls to £109/MWh, still above the cost of fixed bottom offshore wind. However, £41/MWh of this cost is a made-up cost of carbon of £41/MWh. If we remove the cost of carbon, the cost of gas-fired generation falls to £68/MWh, far below the basic cost of offshore wind.

Moreover, the CfD strike price of £90.91/MWh represents only the basic cost of offshore wind. As we have covered before, we need to add the cost of backup, grid balancing and expansion to those costs. In 2024, the cost of backup and balancing was approximately £33/MWh extra for intermittent renewables. That would bring the total to £124/MWh, well above recent market rates of about £80/MWh and remember the CfD is index-linked for 20 years, locking in high prices for two decades.

Miliband went on to claim that the results of this auction would “bring down bills for good,” see Figure 4.

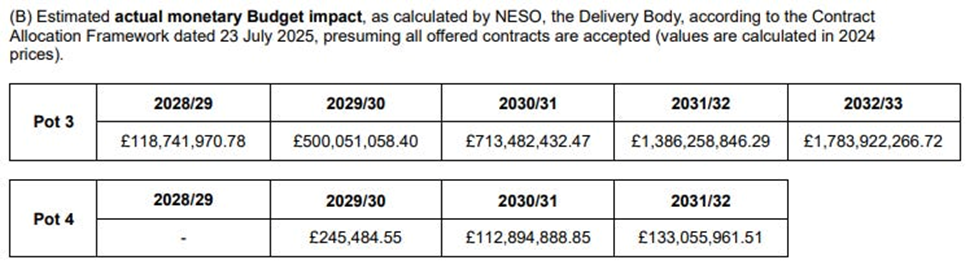

In reality, he has almost doubled the £900 million budget he set for offshore wind in AR7. The expected cost in 2032/33 is now £1.78 billion, meaning he expects to add that amount to electricity bills as subsidies, see Figure 5.

Bills are going to go up, not down. When you think about it, increasing the subsidy budget completely undermines his claim that these offshore wind contracts are cheaper than gas. Of course, Miliband’s Clean Power 2030 plan calls for 35GW of gas-fired generation capacity to remain in place to cover the risk of blackouts, running about 5% of the time. Figure 3 shows he expects this electricity to cost about £424/MWh, further adding to our bills. It would be much cheaper to just build the gas turbines, run them efficiently, eliminate carbon costs and dispense with the wind farms completely.

Ed Miliband also indulged in conspiracy theories, claiming there was a “well-funded right-wing network” waging a war against his plans (see Figure 6).

If he is somehow claiming that your author is part of this network, I ask “Where is the Money?” What does it say about his carefully crafted Net Zero edifice if a few motivated people armed with nothing more than a laptop and more than a couple of brain cells can knock it down so easily? DESNZ is staffed by over 7,000 people and the CCC and NESO are also well-funded and staffed by alleged experts. If the flaws in their plan can be exposed so easily, then it really must be an ivory tower built on sand.

Miliband is playing the victim and gaslighting the nation.

Impact on Costs of Net Zero

Various public bodies, like the CCC and NESO, have published reports on the cost of Net Zero. Their assessments crucially rely on cheap renewables to make their costs look palatable. They assume low capital expenditure, which brings down the upfront costs, and they go on to assume that the use of allegedly “cheap” electricity from these renewables results in lower operating costs from cheap electricity.

As we saw above, the strike price for offshore wind is 2.4 times higher than that assumed by the CCC in CB7. The CCC have not conducted a sensitivity analysis of the impact of higher costs of renewables. However, we can safely say the actual costs of Net Zero will be far higher than their estimates. The results of AR7 put what is hopefully the final nail in the coffin of CB7 and force the CCC to scrap it and start again.

Some readers may have seen the paper I wrote for the IEA (see link below), where NESO’s costs of Net Zero are analysed.

Download: IEA ‘Cost Of Net Zero’ by David Turver

NESO estimated offshore wind would cost £53/MWh, just over half the strike price awarded in AR7. Again, the total gross costs of hitting Net Zero of over £9 trillion will be far higher than their estimates. Both the CCC and NESO are gaslighting the nation with their fantasy costs of Net Zero.

Conclusions

The auction results for AR7 are a disaster for Britain. Miliband is locking in higher prices for intermittent offshore wind for decades to come. We already have the highest industrial electricity prices in the world. Pushing up prices even higher will accelerate deindustrialisation. Among ordinary people, all income groups are feeling some level of anxiety and stress about high domestic energy bills. This concern is leading to a loss of faith and is significant enough for 43% of people to think we should just let our institutions burn.

We cannot afford this madness, and we cannot let Miliband, NESO and the CCC continue to gaslight us about the cost of Net Zero. This is a disastrous policy that is leading to economic distress and causing the social fabric of the nation to unravel. If there really is a well-funded right-wing network out there, the money would be better spent on putting Miliband and his acolytes in the dock for malfeasance in public office.

About the Author

David Turver is a British retired consultant, chief information officer and project management professional. He publishes articles on a Substack page titled ‘Eigen Values’ where he writes about contentious issues such as climate, energy and net zero. You can subscribe to and follow his Substack page HERE.

The Expose Urgently Needs Your Help…

Can you please help to keep the lights on with The Expose’s honest, reliable, powerful and truthful journalism?

Your Government & Big Tech organisations

try to silence & shut down The Expose.

So we need your help to ensure

we can continue to bring you the

facts the mainstream refuses to.

The government does not fund us

to publish lies and propaganda on their

behalf like the Mainstream Media.

Instead, we rely solely on your support. So

please support us in our efforts to bring

you honest, reliable, investigative journalism

today. It’s secure, quick and easy.

Please choose your preferred method below to show your support.

Categories: Breaking News, UK News

Thanks for this another excellent article..

🙏🙏

The Bible prophesied 7-year Tribulation is at humanity’s doorstep & the time to escape is very short. To read more, pls visit https://bibleprophecyinaction.blogspot.com/

As long as energy is not free – or at least almost-free – you are being gaslit.

That is simply because all you need to develop the 1st (real, non-fake) free energy device has been open-sourced and is available publicly at: https://www.KryonEngine.org

Hi Rhoda,

This is a complicated issue, far too complicated for Ed Miliband.

He will be reading this off the back of his note pad.

When the local council made Ed give me a telephone interview, because he never ever replied to my emails.

He could not even remember, if he was a paid up member of ‘ Friends of Israel’.

So what hope have we got?

Hi Dave Owen, “He will be reading this off the back of his note pad.” Are you sure he can read and write?